Table of Content

Fetching a Home Loan statement or Interest Certificate from Magma HFL is a very simple and convenient process. This can be done via online as well as offline modes. We would like to inform you that we are yet to receive your contact details.

Credibility is an important factor which lenders take into account while deciding whether to process a loan application or not. Having a co – applicant in the loan application helps in making the application more flexible in terms of quantum of loan. Attractive interest rates are not the only factor that people consider while going for a loan. People also take into account the process of repayment and various other clauses of significant importance. A Provisional Interest Statement is available any time before the end of the current financial year.

Magma HFL Home Loan Statement and Interest Certificate

During a home loan application process, there is a lot of paperwork involved. Similarly, DHFL also requires legit documents for easy loan processing. Alternatively, the applicant may also visit the online website of DHFL. Once logged on to the website, the applicant has to select the home loan he wishes to apply for. After selecting the relevant home loan type, the applicant is redirected to a new page which holds all the necessary information regarding the loan process. Be it any event, eligibility comes first and is a deciding factor.

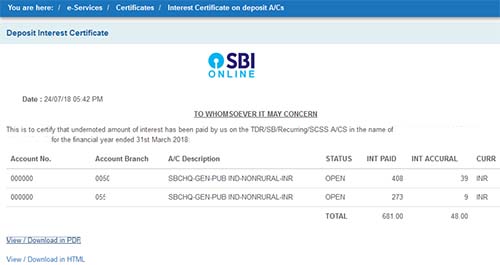

The Home Loan statement is a document that facilitates tracking the repayment of the Home Loan. This document has all the information regarding the total amount paid and also the principal amount outstanding. This document is highly helpful for financial planning for your future.

Similar apps

This mentions the total interest payable on the Cholamandalam Home Loan during that particular financial year. This is usually required for planning income tax and also for managing other finances for the financial year. The Cholamandalam Home Loan statement or Repayment Schedule is easily available throughout the year.

It is always preferable that only the Magma HFL Home Loan applicant or co-applicant visits the branch for obtaining these particular documents. We would like to inform you that we are yet to receive your email ID, mobile & loan account number. Please share the same as it will help us get in touch with you at the earliest. However, request you to share your mobile number as well to help us trace your issue and resolve it at the earliest.

Cholamandalam Home Loan Statement and Interest Certificate

These factors along with other terms and conditions play an important part in establishing one’s eligibility for a loan. Apart from all the mentioned benefits, DHFL Home Loans make you eligible for certain tax benefits as per the prevailing Indian Tax laws. This, in the long run, enables a person to save more money by claiming deductions in income tax, against the principal and repaid interest amount. DHFL currently offers home loans at a Retail Prime Lending Rate of 19.42 %.

Data privacy and security practices may vary based on your use, region, and age. The developer provided this information and may update it over time. Property Documents Proof of ownership of property. In case of flats, allotment letter, sale agreement of builder/society.

About this app

You can find out exactly how much principal and interest you’ve paid on your DHFL home loan by looking at your monthly statement. This statement will help you keep track of your monthly expenses and ensure that your EMI payments are always made on time. If the Income Tax service is investigating your house loan deduction, the home loan statement can be a helpful resource. You can receive your home loan statement by visiting the branch office of DHFL during working hours. You can also generate your statement online through the company's official website. Gone are the days when the work was done manually and took a long time.

Before going ahead with the loan application, it is highly advised that the applicant checks his eligibility to avoid any last-minute hassles or even disappointments at some times. Age is a very crucial factor when it comes to determining an individual’s loan repayment capacity. The applicant must be at least 21 years of age when applying for the DHFL home loan.

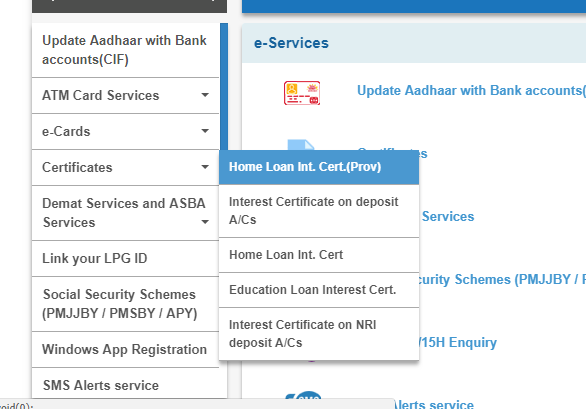

Also, it readily helps you easily understand all the financial implications if you are planning to pre-close your home loan. You can obtain a home loan interest certificate from your bank via a simple process that you can complete online from the convenience of your own home. Most financial institutions now provide consumers with straightforward online access to interest certificates. Income Documents Last 6 months Salary slips and Form No.16 . Last 3 years income tax returns, P/L account, Balance sheet and all other necessary documents along with financials (For self-employed). Top up Loan is additional loan over and above base home loan available for balance transfer cases to existing customers.

For self – employed persons, their business stability and flow of income of more than 5 years. These factors play a vital role in deciding whether the lender will process the loan application or not. For availing DHFL Home Loan, you must be salaried or self – employed. From 1 lakh to 5 crores, you may take any amount for your requirement subject to 80 % of the market value of the house or 85 % of the cost of the property .

The Magma HFL Interest Certificate is a document issued by the company that clearly states the total amount paid as interest on the Magma HFL Home Loan during a specific financial year . This particular certificate is compulsorily required for claiming income tax deduction against the interest paid on Home Loan while filing ITR. This deduction is available as per sections 24B, 80EE, 80EEA of the Income Tax Act as applicable. Existing customers of PFL can login to this app using their registered mobile number. Balance Transfer or Takeover of existing home loan with other financial institute is also possible. For balance transfer of existing loans, customers need to have a good repayment track of their existing loan.

SMS Banking also allows you to check the status of your home loan. Sending an SMS to the relevant institution is all that’s required. Here’s how to get an update through text message.

Home loans with terms of up to 30 years are available from the house financing firm. The processing fee that is levied for a DHFL home loan begins at Rs. 5,000 in addition to any applicable GST. A home purchase demands careful financial preparation. You’ll need to maintain tabs on your finances once you’ve been given a home loan to make timely EMI payments.

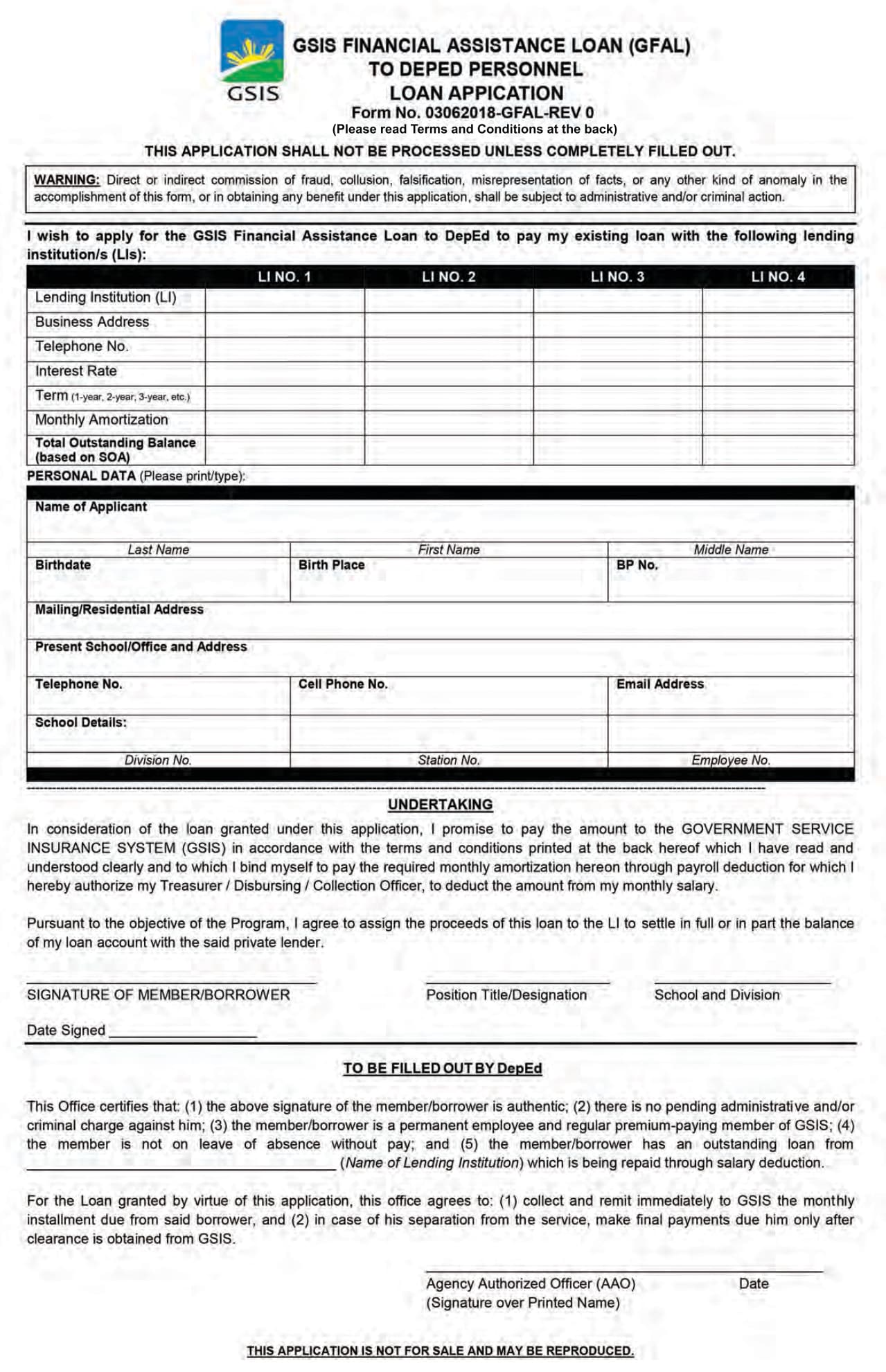

DHFL home loans do not finance the entire property value and are subject to the value of property in the market. The content of this site is copyright-protected and is the property of Piramal capital and housing limited. The relevant form for Home Loan Statement and/or interest certificate/provisional interest statement. Fill in all the required details like Home Loan Account Number, Applicant’s DOB, registered email ID and any other required details as mentioned in the form. ConsumerComplaints.in is a platform for consumers who have had negative experiences with companies.